- Quite a few auto manufacturers entering Vietnam have already operated large scale manufacturing depots (including export) in other ASEAN member states mainly Thailand. Their production cost is less expensive than Vietnam as they benefit from economy of scale. With tariff repeal already affirmed under the common effective preferential tariff (CEPT), GOV's supportive measures are indispensable for them to continue auto production. While the master plan has been published, as of today, its substantive terms and incentive measures are nebulous.

- Application terms and the method of filing application are ambiguous on the corporate income tax (CIT) incentives.

- As regards incentive on auto and motor cycle business expansion, there is a gap between tax office legal interpretation and investment licence.

- It is requested that GOV affirms as soon as possible the clear-cut substantive terms and conditions, as well as the application method for the incentive acquisition.

- It is requested GOV clearly identifies the terms and conditions for application of CIT incentive and the method of filing application.

- It is requested that GOV continues with incentive under investment licence.

- Decision 49/2010/QD-TTg and Decision 66/2014/QD-TTg

- Auto Industries Development Strategy/ Its Master Plan (Premier Approval in July 2014)

- Resolution 63/NQ-CP

- Investment Law 2005, Decree 108/2006/ND-CP by Gov

- Law on Enterprise Income Tax 2008 & revised in 2013

- Decree 218/2013/ND-CP by Gov

- Circular 78/2014/TT-BTC by MOF

- Article 3 of "the WTO Agreement On Subsidies And Countervailing Measures" prohibits export subsidies and investment incentive for export promotion. With the Vietnam's accession to WTO, export subsidy and subsidy for import substitutes are repealed and tax incentive for promotion of export substitutes is repealed after five-years of Vietnam's accession to WTO.

- GOV on 14 March 2008 promulgated Decree No. 29-2008-ND-CP (Decree 29) "On Industrial Zones, Export Processing Zones and Economic Zones". The Decree stipulates incentives applicable to Industrial Zones and Economic Zones, besides the organisation, operation, policies and State administration of Industrial Zones, Export Processing Zones, Economic Zones and Border-gate Economic Zones. Decree 29 published in Official Gazette Nos. 201 and 201 of 26 March 2008 was enforced on 10 April 2008, repealing any contrary prior Decisions and Decrees.

- Prime Minister Nguyen Tan Dung promulgated on 14 February 2008 Official Letter No. 227/TTg-KTTH on Measures for Pushing Up Export and Import in 2008, directing the collaborative effort between government and private sectors to draw up plans to expand production for export products and to strengthen production capacity for the requisite raw materials used for export products. More precisely, it provides among others for: (1) establishment of production assisting centre of raw materials for export products, (2) authorisation within 2008 of 100% foreign investment into the production facilities for raw materials used for export products, and (3) drawing up the measure for export promotion consistent with the WTO Agreement.

- From FY2007, the tax incentive measure linked to export performance on textile and clothing is repealed. (Decree No. 24, Section 46(2)

- Investment projects satisfying the following enjoy preferential tax rates:

(1) Investment into domains described in "the list of domains entitled to special investment preferences and domains entitled to investment preferences";

(2) Investment into geographical areas described in "the list of geographical areas facing extremely difficult socio-economic conditions and geographical areas with difficult socio-economic conditions"; and

(3) Investment into newly established business enterprise (BE) described in "The list of domains entitled to special investment preferences" or "The list of geographical areas with extremely difficult socio-economic conditions".

These lists are detailed in Decree No. 108/2006/ND-CP (Decree 108) of 22 September 2006, "Detailing and guiding the implementation of a number of articles of the investment Law." Preferential tax rates of 10%, 15%, and 20% are applied in accordance with the circumstances/conditions of each case for the duration of 10, 12 and 15 years, respectively. Upon expiry of the duration prescribed above, the regular CIT rate of 28% applies in general. If BE's relocates the place of business operation, preferential tax rates no longer apply, with the exception of CIT exemptions or reductions. CIT's payable by BE's newly established from investment projects and by BE's which relocate shall be exempted or reduced as follows:

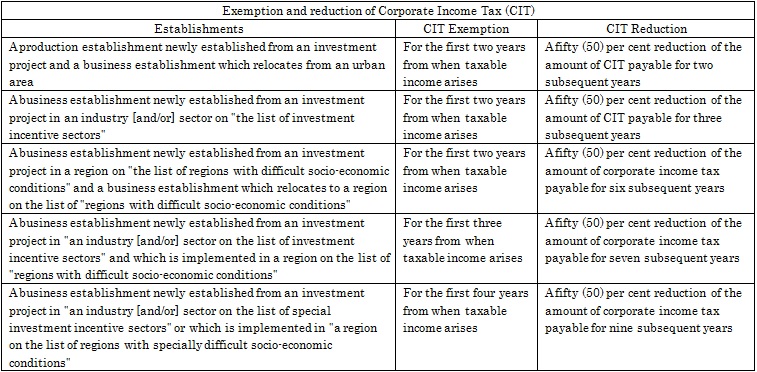

Exemption and reduction of Corporate Income Tax (CIT)

-- Establishments: A production establishment newly established from an investment project and a business establishment which relocates from an urban area

--- CIT Exemption: For the first two years from when taxable income arises

--- CIT Reduction: A fifty (50) per cent reduction of the amount of CIT payable for two subsequent years

-- Establishments: A business establishment newly established from an investment project in an industry [and/or] sector on "the list of investment incentive sectors"

--- CIT Exemption: For the first two years from when taxable income arises

--- CIT Reduction: A fifty (50) per cent reduction of the amount of CIT payable for three subsequent years

-- Establishments: A business establishment newly established from an investment project in a region on "the list of regions with difficult socio-economic conditions" and a business establishment which relocates to a region on the list of "regions with difficult socio-economic conditions"

--- CIT Exemption: For the first two years from when taxable income arises

--- CIT Reduction: A fifty (50) per cent reduction of the amount of corporate income tax payable for six subsequent years

-- Establishments: A business establishment newly established from an investment project in "an industry [and/or] sector on the list of investment incentive sectors" and which is implemented in a region on the list of "regions with difficult socio-economic conditions"

--- CIT Exemption: For the first three years from when taxable income arises

--- CIT Reduction: A fifty (50) per cent reduction of the amount of corporate income tax payable for seven subsequent years

-- Establishments: A business establishment newly established from an investment project in "an industry [and/or] sector on the list of special investment incentive sectors" or which is implemented in "a region on the list of regions with specially difficult socio-economic conditions"

--- CIT Exemption: For the first four years from when taxable income arises

--- CIT Reduction: A fifty (50) per cent reduction of the amount of corporate income tax payable for nine subsequent years

(Note) The preferential tax rates prescribed above and the exemption and reduction of CIT only applies to newly established business establishments which practice independent cost accounting and which pay tax pursuant to a tax declaration.

- MOST on 19 May 2007 promulgated Decree No.80/2007/ND-CP (Decree 80), "On science and technology enterprises". By Decree 80, Vietnamese and foreign organisations and individuals may apply for the setting up of Science And Technology Enterprises under Uniform Law on Enterprise and Law on Science and Technology. An enterprise satisfying the followings is entitled to benefit from the corporate income tax (CIT) incentives:

-- The enterprise has obtained the grant of Scientific and Technological Enterprise Certificates.

-- The revenue from production, sale and purchase of scientific and technological products is more than 30% of the total revenue in the first year, more than 50% in the second year and more than 75% in the third year and thereafter.

In addition to the CIT incentives, the enterprise will be exempted from payment of the registration fee upon registration of land use right or house ownership right.

- On 22 June 2007, Prime Minister Nguyen Tan Dung promulgated Directive 15/2007/CT-TTg, directing each governmental agency to conduct research and to lay down the action plan for luring foreign investors.

- GOV prepared new draft Decree that provides additional incentive measure for the benefit of projects in the special economic zones to ensure further economic development of Vietnam and to attract foreign investment. The draft Decree provides special incentive measure such as reduction in the CIT rates for the high-tech related projects and projects in the socio-economically retarded area. In the context of the MOF Circular No. 76/2007/TT-BTC (Circular 76), "Guiding the Financial Regime and Customs Procedures Applicable in Chu Lai Open Economic Zone (CLOEZ) Quang Nam Province", 5 July 2007, the 10% beneficial CIT rate applies to investors investing in CLOEZ for fifteen-years from the beginning of operation in CLOEZ. The high-tech related projects and projects that greatly contribute to the socio-economic development of the area in concern are included in this special incentive measure. GOV plans to construct 22 new special economic zones within the year 2007.

- MOF promulgated on 2 August 2007 Circular No. 93/2007/TT-BTC (Circular 93), "Guiding some mechanisms and policies on financial and non-financial incentive measures for Phu Quy island, Binh Dinh Province". The 10% CIT rate applies for 15-years to investing projects that involves establishment of a new production foothold or a new enterprise. CIT is exempted for 4-years from the accounting year showing taxable income for the first time, while the CIT is reduced by 50% in the subsequent 9-years. The 10%-CIT rate applies to high-tech projects and large-scale projects impacting on the socio-economic conditions of the total island.

- MOF on 7 September 2007 promulgated Circular No. 108/2007/TT-BTC (Circular 108), "Guiding the financial management mechanism applicable to ODA programs and projects" which serves as implementing regulation for Decree No. 131/2006/ND-CP (Decree 131) of 9 November 2006, "Promulgating the regulation on management and use of official development assistance". Circular 108 applies to projects under the preferential borrowing from ODA fund during the preparatory stage and execution stage, free ODA, and partially free ODA. MOF also promulgated Circular No. 123/2007/TT-BTC (Circular 123) of 23 October 2007, "Guiding the implementation of tax policy and tax incentives for programs and projects funded with Official Development Assistance (ODA)", addressed to projects under ODA and its programmes.

- MOF promulgated, on 11 October 2007, Official Letter No. 13721/BTC-TCT (OL 1372), "On Tax Policies for Capital Transfer", guiding Provincial/Municipal Tax Departments. By the force of OL 1372, GOV has applied the 28% tax rate for capital gains obtained from January 2004 and thereafter.

- MOF promulgated, on 23 November 2007 and enforced from 18 December 2007, Circular No. 134/2007/TT-BTC (Circular 134), "Guiding the implementation of the Government's Decree No. 24/2007/ND-CP (Decree 24) of February 14, 2007", "Detailing the implementation of the Law on Business Income Tax". Circular No. 134 stipulates MOF's policy on individuals and enterprises subject to tax levy, on taxable income, deductible expenses and the guidelines for the incentive measures. Circular No. 134 expands the scope of the deductible expenses to include deduction of depreciation cost related to the fixed assets for employees, besides allowing deduction from taxable income of maximum 10% for sales promotion and advertising expenses (excluding market research expenses). While Circular No. 134 permits application of the preferential CIT rate as the special investment preferential measure for projects in "Socio-economically extremely retarded area", it has repealed in principle the tax incentive measure for export textile and clothing industry that uses the domestic raw materials, taking the form of a newly incorporated state industry or other textile and clothing enterprise. Circular No. 134 has repealed Circular No. 128/2003/TT-BTC of 22 December 2003, Circular No. 88/2004/TT-BTC of 1 September 2004 and all other regulations conflicting with Circular No. 134.

- On 3 March 2009, Ministry of Finance published Guidance on Repeal of the preferential measures for corporate income tax based on the local procurement rates and export rates, in order to fulfill its undertaking upon accession to WTO concerning the preferential measures for corporate income tax.

- On 14 June 2010, General Department of Vietnam Customs released Official Letter 2057TCT-CS, providing that the regular Corporate Income Tax of 25% applies to any income generated from businesses added after the acquisition of the Investment Licence. In this case, no preferential tax measures shall apply.

- In February 2012 (5-years after accession to WTO), GOV repealed the Incentive Measures to Enterprises in Border-Gate Economic Zones. The Incentive Measures used to allow the following preferential tax rate compared to the going 25% Corporate Income Tax (CIT) Base Rate:

-- tax rate of 20% for 10-years for enterprises investing into Socially and Economically Difficult Regions (namely, CIT exemption for the first 2-taxable years, thereafter 50% reduction in CIT for 4-years);

-- tax rate of 10% for 15-years (extendable) for enterprises investing into Socially and Economically Especially Difficult Regions (namely, CIT exemption for the first 4-taxable years, thereafter 50% reduction in CIT rate for 9-years);

-- tax rate of 10% for 15-years (extendable) for enterprises investing into High Technology, Chemical Research, Technical Development, especially important infrastructure development, software development sector (extendable), CIT exemption for the first four taxable years, thereafter 50% reduction in CIT rate for 9-years).

- Prime Minister Nguyen Tan Dung approved "Decision No. 631/Q?-TTg dated April 29, 2014, promulgation of the List of National Projects in which Foreign Investments are called for by 2020". These Projects will enjoy the exclusive support of Ministry of Planning and Investment.

- On 2nd March 2009, Prime Minister Nguyen Tan Dung promulgated Decision No. 33/2009/QD-TTg concerning application of priorities in terms of tax and finance to enterprises investing in border economic zone (EZ) (enforcement from 1 May 2009). The Decision concerns the EZ under the Administrative Committee and non-tariff areas within EZ under jurisdiction of Vietnam Customs Office. The details of the financial/tax preferential measures comprise of exemption or reduction of corporate income tax, personal income tax, VAT, special sales tax, export/import tariffs, land and sea-surface rental fees, land utility fees, the details of which are as follows:

-- Preferential 10% tax rate over 15-years, provided, however, that, preferential measures may be extended up to 30-years maximum, for projects invested on business sectors so designated under Decree No. 124, Article 15.1(b), high technology as prescribed by law; scientific research and technological development, manufacture of software products, and development of water plants, power plants, water supply and drainage systems; bridges, roads, railways; airports, seaports, river ports; airfields, stations and other infrastructure works of special importance.

-- Tax exemption for maximum 4-years, and 50% tax reduction for the subsequent 9-years. These measures for tax exemption/reduction will be applied from the year in which enterprises gain profit for the first time. Should there be no profit in the subsequent 3-year period from the first time enterprises gain profit, these measures for tax exemption or reduction will be applied from the 4th year.

- On 17 June 2010, Ministry of Finance (MOF) promulgated (and enforced on the same date) Circular No. 92/2010/TT-BTC "Guiding procedures for the payment extension and refund of value-added tax on equipment, machinery, special-use vehicles included in technology lines and on construction supplies which cannot be produced at home and need to be imported to create fixed assets of enterprises". Goods subject to this Circular are: (1) Equipment, machinery and special-use vehicles included in technology lines and construction supplies, and (2) Goods, which are unavailable at home, forming the fixed assets of enterprises. Circular No.92 also provides: "Business establishments newly set up under investment projects which are in the stage of investment and have not yet been put into operation and operating business establishments which have investment projects (on building of new production lines, expansion of production scope, renewal of technology, improvement of the eco-environment or rising of production capacity)." Payment extension and refund of value-added tax are not authorised unless the value of the foregoing imports exceeds VND200 billion.

- On 28 December 2010, Ministry of Finance (MOF) promulgated Circular No. 214 /2010/TT-BTC, providing Guidelines for the Policy on Preferential Import Tax applicable to Imported Materials and Equipment for Investment in Production or Project of Major Mechanical Products (entered into force on 11 February 2011). Production and Project of Major Mechanical Products under Decision No. 10/2009/QD-TTg 16 January 2009 of the Prime Minister during 2009-2015 are provided in:

Appendix 1 List of Key Mechanical Products During 2009-2015, and

Appendix II List of Investment Projects to Manufacture Key Mechanical Products during 2009-2015 of this Prime Minister's Decision.

During the period from 2009 to 2015, within 45-days of the completion of manufacture or manufacturing project of Major Mechanical Products, enterprises in concern must complete the requisite procedures on import and import tariff exemption for the subject goods at the Customs Authority at which the Listed Product(s) is (are) registered.

- Since 1 January 2014, new investment project (2009 through 2013) industrial zone has been approved as incentive zone entitled to receive tax incentive measures (2-years of tax exemption and 4-years of tax reduction).

- Amendment to Tax Law in February 2014 has replaced the goods subject to 10% preferential tax rate for 15-years under the Tax Law before Amendment) with the prioritised high-tech fostering, reusable energy production, environmental protection projects.

- On 26 November, 20014, New Law on Investment (67/2014/QH13) was promulgated and enforced from 1 July 2015.

(1) Investment incentive business lines listed comprise of 13-items, with areas of interest clearly identified. (Article 16)

(2) List of investment incentive business lines has been expanded by addition of hi-tech auxiliary industrial products, manufacture of products with added value of more than 30%, energy saving products, peoples credit fund, etc.

(3) Administrative divisions given investment incentives include disadvantaged area or extremely disadvantaged areas; industrial parks, export-processing zones, hi-tech zones, economic zones.

(4) Beneficiaries of investment incentives include:

i) Any project in which the capital investment is at least VND 6,000 billion, or at least VND 6,000 billion is disbursed within 03 years from the day on which the certificate of investment registration or decision on investment policies is issued;

ii) Any investment project in a rural area that employ at least 500-workers; and

iii) High-tech companies, science and technology companies, and science and technology organizations.